The Ultimate 2024 Guide to the American Express® Gold Card

Note: The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Terms apply to American Express benefits and offers. Visit AmericanExpress.com to learn more.

Key Points

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

Get the American Express® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design. White Gold design is only available while supplies last.

Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

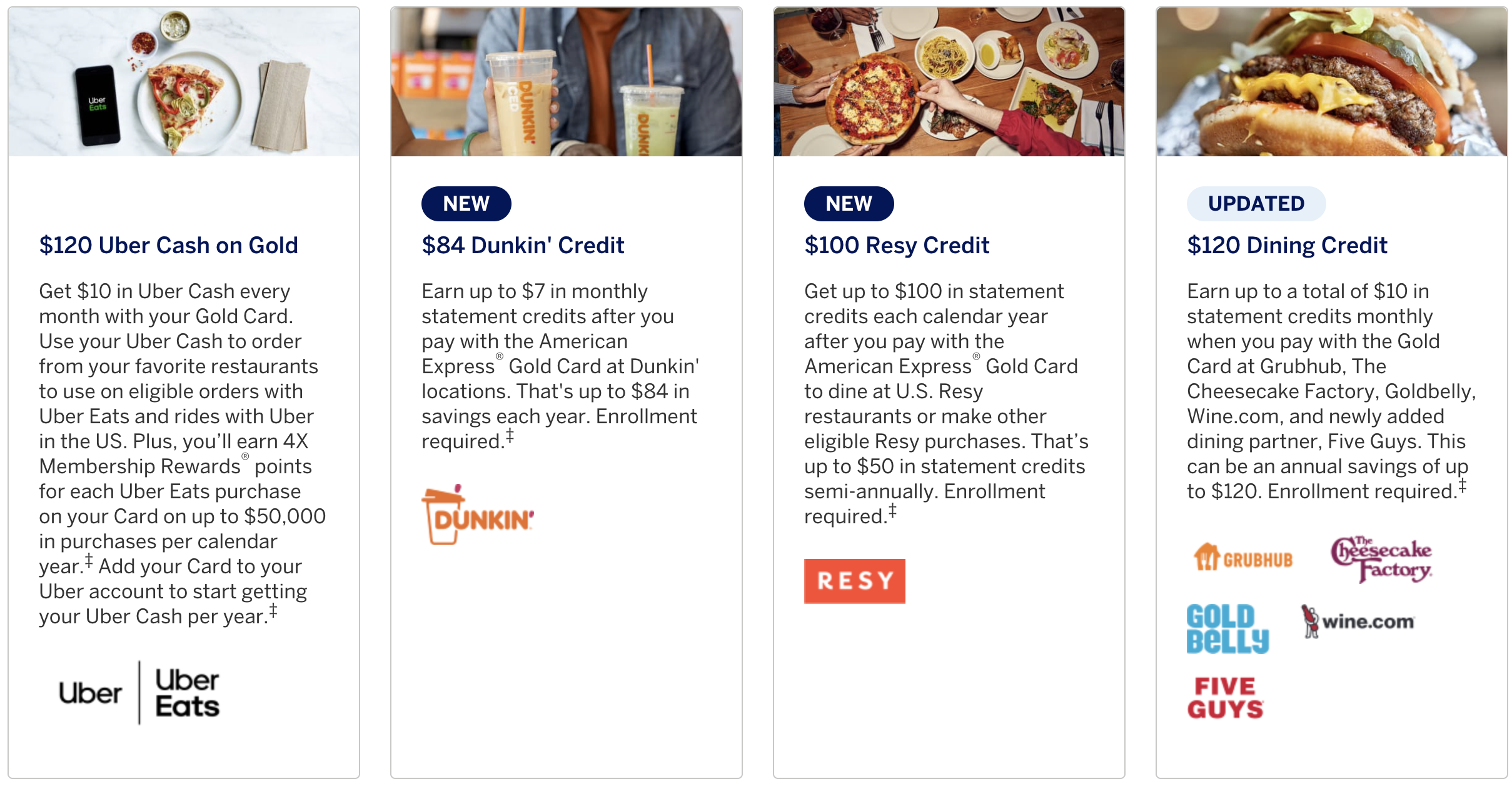

$120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

$84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at Dunkin' locations.

$100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

$120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit to use towards eligible charges, which may include food and beverage, spa, or other on-property charges with every booking of two nights or more through AmexTravel.com. Credit use varies by property.

No Foreign Transaction Fees.

Annual Fee is $325.

Terms Apply.

Are you interested in adding the American Express® Gold Card to your wallet? Learn more with the link below and scroll down to the card that’s perfect for you!

The American Express Gold Card is the ultimate card for foodies!

To the Point

American Express® Gold Card is the perfect card for anyone who eats food and loves to travel! The key benefits start off with the massive 60,000 Membership Reward point welcome offer (after meeting the $6,000 spend requirement within the first six months). After that, you’ll earn 4X points on dining globally (up to $50,000)and 4X points at U.S. Supermarkets (up to $25,000). On top of that, you’ll earn 3X points with airlines.

Now, this card does have a $325 annual fee, BUT don’t let that scare you just yet! The American Express® Gold Card offers up to a $120 annual dining credit in $10/month amounts. It also has up to $120 in Uber Cash, which is automatically deposited as $10/month into your Uber account once you enroll and add the American Express® Gold Card to your Uber account. On top of that, there’s up to $100 in annual Resy Credits ($50 every 6 months), and up to $7/month for Dunkin’ Donuts (up to $84/year).

That means you can receive up to a total of $424 in annual credits, which more than completely offers that annual fee if you’re able to take advantage of all of the credits! On top of that, the 4X on groceries and dining is one of the best earnings rates of any card right now.

The American Express® Gold Card Credits Now Add Up to $424 in 2024

The American Express® Gold Card currently has the following annual statement credits:

2024 American Express Gold Card Statement Credits

Up to $120 ($10 per month) dining credit

Up to $120 ($10 per month) Uber Cash

Up to $100 ($50 twice a year) Resy credit

Up to $84 ($7 per month) Dunkin’ Donut credit

Total Annual Credits: up to $424 per year

Annual Fee: $325

= Net Annual Fee: +$99 (offsets the fee!)

The 60,000 Membership Rewards Welcome Bonus

Forget the Welcome Bonus of only 35,000 Membership Reward points that the American Express® Gold Card previously had. It’s time to kick off 2024 the right way with a Welcome Bonus of 60,000 Membership Reward points! We value these points at 2.0 CPP (Cents Per Point), or $0.02/MR point. That means that we value this limited-time offer at a massive $1,200!

That’s enough points to redeem for an international business class flight to Europe in lay-flat seats or to transfer to a hotel partner such as Marriott for a stay at the Ritz-Carlton Half Moon Bay!

You can redeem Membership Reward points for international business class flights!

You can redeem Membership Reward points for international business class flights!

Remember, American Express has a lifetime limit on their Welcome Bonus. This means that once you sign up for a card, you won’t be eligible for a future Welcome Bonus on the same card, even if you cancel it. That’s why it’s important to take advantage of signing up for American Express cards when they’re offering the highest bonuses like the American Express® Gold Card currently is.

Even after you redeem your points, the American Express® Gold Card will continue to pay dividends for years to come with its 4X Membership Reward points earning power at U.S. Supermarkets, 4X Membership Reward points at Restaurants, including takeout and delivery, 3X Membership Reward points on airfare, and 1X Reward points on everything else. See rates & fees.

The American Express Gold Card earns 4X Membership Reward points at U.S. Supermarkets, such as Safeway, Publix, Trader Joe's, Whole Foods, and many, many more!

The American Express Gold Card earns 4X Membership Reward points at U.S. Supermarkets, such as Safeway, Publix, Trader Joe's, Whole Foods, and many, many more!

Why You Need This Card in 2024: It Adds Up

Now that you know what this Welcome Bonus is worth and that unique opportunity that’s available to you with the change with this card’s annual credits, let’s add it all up.

2024: Statement Credits and Welcome Bonus

60,000 Membership Reward Welcome Offer (+$1,200 in value)

$120 Annual Dining Credits ($10/month)

$120 Annual Uber Credits ($10/month)

$100 Annual Resy Credits ($50/bi-annually)

$84 Annual Dunkin’ Donut Credits ($7/month)

$325 Annual Fee

= $1,299 Total Net Value

2025 & Beyond: Statement Credits

$120 Annual Dining Credits ($10/month)

$120 Annual Uber Credits ($10/month)

$100 Annual Resy Credits ($50/bi-annually)

$84 Annual Dunkin’ Donut Credits ($7/month)

$325 Annual Fee

= +$99 Net Annual Fee

Let’s face it: having the American Express® Gold Card offer new applicants over $1,600+, even after considering the annual fee, is just wild! Now you can have a low net annual fee of only $10! That’s without factoring in the 60,000 Membership Reward points and all the exciting places they can take you for free.

The American Express Gold Card is a key to unlocking free travel around the world. Even when staying at the W Barcelona and using the American Express Gold Card in Spain, you can earn 4X Membership Reward points on dining!

The American Express Gold Card is a key that can unlock free travel around the world. Even when staying at the W Barcelona and using the American Express Gold Card in Spain, you can earn 4X Membership Reward points on dining!

The Final Point

Now that you know what this Welcome Bonus is worth and that unique opportunity with the statement credits that are currently available, we believe you have all the data needed to determine whether this is the right time for you to add the American Express® Gold Card to your wallet. If you want to research this card further, check out our American Express Gold Card Deep Dive Review, which outlines every benefit beyond this article's scope.

Our first rule for taking advantage of credit card points is never to carry a balance and never pay interest. However, it's worth noting that the American Express Gold Card has the option to pay for certain charges over time, and the Annual Percentage Rate (APR) is based on the Pay Over Time APR (21.24% to 29.24% variable APR on eligible charges).

The ability of this card to bring you up to $1,200+ in value in 2024 is beyond excellent! If you’ve been on the fence about the American Express® Gold Card, we strongly recommend that you consider it while this rare opportunity is available! If this article was valuable, we greatly appreciate you considering using our links when applying for your next credit card. Your support helps our small business create new content and bring value to people like you!

Are you interested in adding the American Express® Gold Card to your wallet? Learn more with the link below and scroll down to the card that’s perfect for you!

Any questions about the American Express® Gold Card or any other card? Please let us know by DMing us on Instagram, or by messaging us on Facebook! You can also email us anytime with any feedback or questions at hello@thepointspassport.com!

Note: All information about the American Express Gold Card have been collected independently by The Points Passport and has not been reviewed by the issuer.