Earn Lifetime Status and a $225 Statement Credit!

Last Updated: 08/23/2020

We’re more than halfway through 2020 and most of us have been impacted one way or another by the COVID-19 pandemic. From travel plans being canceled to reduced ways to use the benefits that many of us have come to enjoy and love on our favorite travel credit cards, it’s been a challenging year. American Express has added a $200 AMEX Travel Appreciation Credit, streaming and wireless statement credits, and AMEX Offer for $50 to support small businesses. Chase started with a $100 statement credit for Chase Sapphire Reserve cardholders that were renewing their cards then increased rewards by offering 5X Ultimate Rewards on groceries, then later offered up to 10X Ultimate Reward points on streaming services and 5X points on gas. Both American Express and Chase increased benefits, statement credits as well as non-travel points earnings. Not to be left out, Citibank and American Airlines recognized that cardholders of the Citi/AAdvantage Executive World Elite MasterCard haven’t been able to take advantage of the main reason they hold the card, the full Admirals Club Membership. Citibank is now offering cardholders a reason to keep the card into 2021: a $225 courtesy statement credit and a path towards lifetime American Airlines elite status!

At $650 per year for an individual, American Airlines doesn’t exactly give away an annual membership to their vast Admirals Club network. While there are some discounts if you have AAdvantage Elite Status, it still quickly escalates to over $1,200+ for a household membership. So if you find yourself traveling frequently with American Airlines, in a normal year, it really makes sense to get the Citi/AAdvantage Executive World Elite MasterCard. This card’s main feature and reason to have it is simple: it grants you unlimited access to the American Airlines Admirals Club for yourself and two guests, every time you fly on American Airlines. To make it even more interesting, you can add up to 10 Authorized Users, who can also have access to the Admirals Club and bring in up to two guests, even when they’re not flying with the primary cardholder. This is why we called it the “Netflix of Lounge Access”.

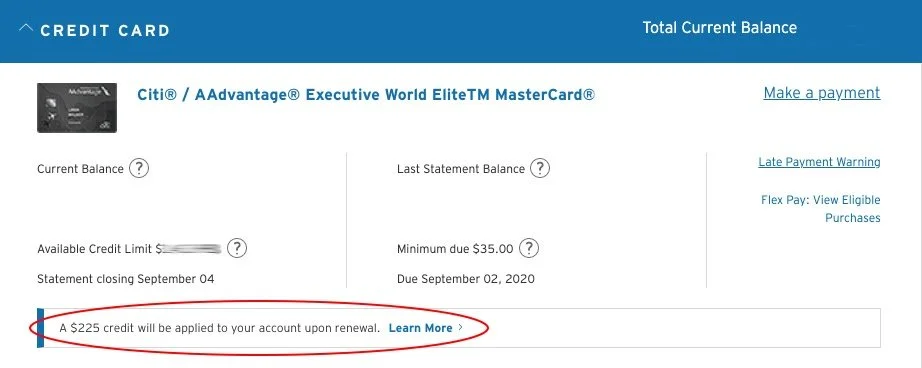

To help offset the $450 annual fee cost and to encourage current cardholders to keep the Citi/AAdvantage Executive World Elite MasterCard into 2021, Citibank is offering a “one-time” $225 courtesy statement credit. This statement credit will post 1-2 billing cycles after the renewal of the card. One thing that I always find frustrating is that card issuers and businesses always seem to be able to charge you for whatever service they provide right away, but whenever you are due a credit, it always takes much longer. Minor complaint aside, I’m very grateful that they’re offering this statement credit. Let’s take a look at how this all works out for my travel with American Airlines in 2020. A day pass at the Admirals Club typically costs $59 per person per day, so I’ll use that to calculate the value that I got out of the Citi/AAdvantage Executive World Elite MasterCard in 2020 during a global pandemic.

January 2020: SFO Admirals Club: 4 guests ($59 x 4 = $236 equivalent day pass cost)

February 2020: SFO and DFW Admirals Clubs: 1 guest ($59 equivalent day pass cost)

March 2020: SFO, LAX, and SAN Admirals Clubs: 4 guests ($59 x 4 = $236 equivalent day pass cost)

March 2020: SAN Admirals Club: 4 guests ($59 x 4 = $236 equivalent day pass cost)

July 2020: DFW Admirals Club: 2 guests ($59 x 2 = $118 equivalent day pass cost)

July 2020: MIA Admirals Club: 3 guests ($59 x 3 = $177 equivalent day pass cost)

July 2020: LAX Admirals Club: 3 guests ($59 x 3 = $177 equivalent day pass cost)

Total Personal Admirals Club Entries: 7 entries at $59 each = $413 day pass equivalent cost

Total Guest Admirals Club Entries: 14 entries at $59 each = $826 day pass equivalent cost

Total Cost Equivalent: $1,239

2020 Annual Fee: $450

Profit/Loss: +$789 (Saved)

Now let’s factor in the $225 statement credit: $450 annual fee - $225 courtesy statement credit = $225 Net Annual Fee Cost (2020)

So, updating the quick analysis above for when I visit the Admirals Club so far in 2020, we find:

Total Cost Equivalent: $1,239

2020 Annual Fee (including statement credit): $225

Profit/Loss: +$1,014 (Saved)

Those are some respectable numbers for 2020! This card doesn’t get as much attention as the Platinum Card from American Express with the Centurion Lounge access, but in a year when the Centurion Lounges have been closed globally since March, the Citi/AAdvantage Executive World Elite MasterCard continues to deliver significant value, even with limited locations currently operating with adjusted services. While our travel in 2020 is quite limited compared to normal years, the Citi/AAdvantage Executive World Elite MasterCard is even more valuable as it’s one of the few non-Priority Pass lounges that are actually open! As if that’s not enough value, there’s even another unique twist for 2020: lifetime American Airlines Elite Status.

Lifetime status isn’t something that’s talked about too often on most travel blogs and is even more rarely discussed on social media, as it tends to be out of reach for a lot of people. It also requires some serious commitment to one airline. As with any relationship in life, you’ll find that over time you’ll get out of it whatever you put into it. Lifetime elite status unlocks benefits such as complimentary upgrades, priority security screening, priority boarding, and complimentary checked bags.

When looking long term and realizing how much this could save you, your family, your kids, and your grandkids, it really is worth looking at if you plan to travel your entire life. Starting at 1 Million Miles for lifetime American Airlines Gold Elite status and 2 Million Miles for lifetime American Airlines Platinum status, it’s not something that you can easily qualify for. Years ago, you used to be able to earn miles that counted for lifetime status with credit card spend, but on December 1, 2011, that went away. The only way to earn miles towards million miler status between December 1, 2011, and April 15, 2020, was to physically fly, which are referred to as “butt-in-seat” miles. These are different from modern EQMs (Elite Qualifying Miles), as modern EQMs are a formula based on your status level times your ticket fare. Miles for million miler status are still calculated the old school way of how far you physically flew. Now in 2020, Citibank and American Airlines are once again allowing the miles you earn from spending on your Citi/AAdvantage Executive World Elite MasterCard to count towards Million Miler status. This means that for every $1 you spend on your card now earns you 1 mile towards Million Miler status, in addition to the normal 1x American Airlines AAwards miles. If you run a small business or are remotely close to lifetime AAdvantage Elite status, this is definitely a year to consider shifting your necessary spend from your other cards to a Citibank AAdvantage card.

While 2020 has been nothing but short of challenging, there have been a few bright spots. One of them is how all of the card issuers have come to the table to help maintain their customers through numerous types of credits, and it’s great to see that Citibank is taking care of their customers that continue to hold the Citi/AAdvantage Executive World Elite MasterCard into 2021!