American Express Marriott Bonvoy Brilliant Deep Dive Review 2020

The Marriott Bonvoy Brilliant Card has gotten us free nights at the Westin Grand Cayman, located in the beautiful Cayman Islands.

“Next-Level Luxury”

Key Benefits

75,000 Marriott Bonvoy Points Sign-Up Bonus (valued at $600*)

6x Marriott Bonvoy Points on Marriott purchases

3x Marriott Bonvoy Points on flights booked directly with airlines

2x Marriott Bonvoy Points on all other purchases

Annual $300 Marriott Bonvoy Statement Credit

Annual Free Night Award (at or under 50,000 Marriott Bonvoy Points)

Complimentary Gold Elite Status (Platinum Elite if you spend $75k or more)

15 Elite Night Credit (Towards the next status level)

Airport Lounge access with Priority Pass Select

$100 Global Entry/TSA Pre Fee Reimbursement

17.24% to 26.24% variable APR on purchases

To the Point

The Marriott Bonvoy Brilliant card from American Express is a must-have for frequent Marriott guests or anyone looking to take advantage of Marriott’s global properties, brands, or vast network of airline and other travel transfer partners. Several unique benefits place this card above all other co-branded Marriott cards, especially if you travel for work, even if you already have other premium cards stacked in your wallet. From the 6x Marriott Bonvoy earning power with Marriott, the complimentary Gold Elite status, to the 15 Elite night credits to help you hit Platinum or Titanium Elite if you’re close (but need a little edge to help you clinch the next level). Even if Elite status with complimentary upgrades and numerous benefits isn’t your primary goal, this card is still noteworthy, as we’re consistently seeing more value from holding the card than the (arguably) high annual fee. To kick off your Marriott Bonvoy point game, this card currently offers a 75,000 Bonvoy point bonus after you hit the $3,000 spend requirement in the first 3 months you have the card. If you’re ready to enjoy Marriott properties around the world with one of the best co-branded cards on the market, click our link below. Not ready? Not a problem, keep reading below to see why we think everyone should consider this card for their wallet

Interested in applying? Apply below for the Marriott Bonvoy Brilliant card from American Express and get 75,000 Marriott Bonvoy points as a sign up bonus, which is worth $600 based on our valuations of $0.008/Bonvoy point. Your value may vary based on how you optimized and redeem your Marriott Bonvoy points. (See rates & fees)

Deep Dive into the American Express Bonvoy Brilliant Card’s Primary Benefits

A lot of the card’s benefits will overlap with other premium cards, such as the Chase Sapphire Reserve and the American Express Platinum card, so let’s start off with the key benefits that differentiate this card from other premium cards on the market: the annual Marriott statement credit, the annual free night award, strong Marriott Bonvoy points earning power, and elite status benefits.

Every year, you’ll get a $300 annual statement credit for any spend with Marriott. Remember that trip you wanted to take to the Caribbean? That $1,200 hotel bill at the Ritz-Carlton Grand Cayman isn’t nearly as bad when you check your Marriott Bonvoy Brilliant card to only find out that you now owe $900, since you’ll receive $300 as a card statement credit for eligible charges at Marriott properties worldwide. You get the point.

Speaking of points, the 6x Bonvoy points per dollar spent with Marriott is one of the highest available! While most people (even Marriott employees) believe this is the secret weapon to earning the most Marriott Bonvoy points possible, you can actually earn 10x Marriott Bonvoy points per dollar spent with the American Express Platinum card. Feel free to check out our deep dive on that card here, but despite not being the absolute best earning card, 6x Marriott points per dollar spent is still excellent, especially when combined with all of the other benefits. Remember that $1,200 charge you put on your card and got the $300 statement credit? You’re still earning 6x on that $1,200, which is 7,200 Marriott Bonvoy points. We’ll discuss what we value Marriott Bonvoy points at later, but needless to say, it adds up if you find yourself staying at Marriott properties frequently or spending a decent amount when you are there. You’ll also earn 3x Bonvoy points on any flights you book directly with the airline, although this wouldn’t be our first choice card for flights for several reasons. Outside of those two categories, this card will earn you 2x Marriott Bonvoy points on all other purchases, which includes American Express’ “Return Protection”, which we’ll discuss later.

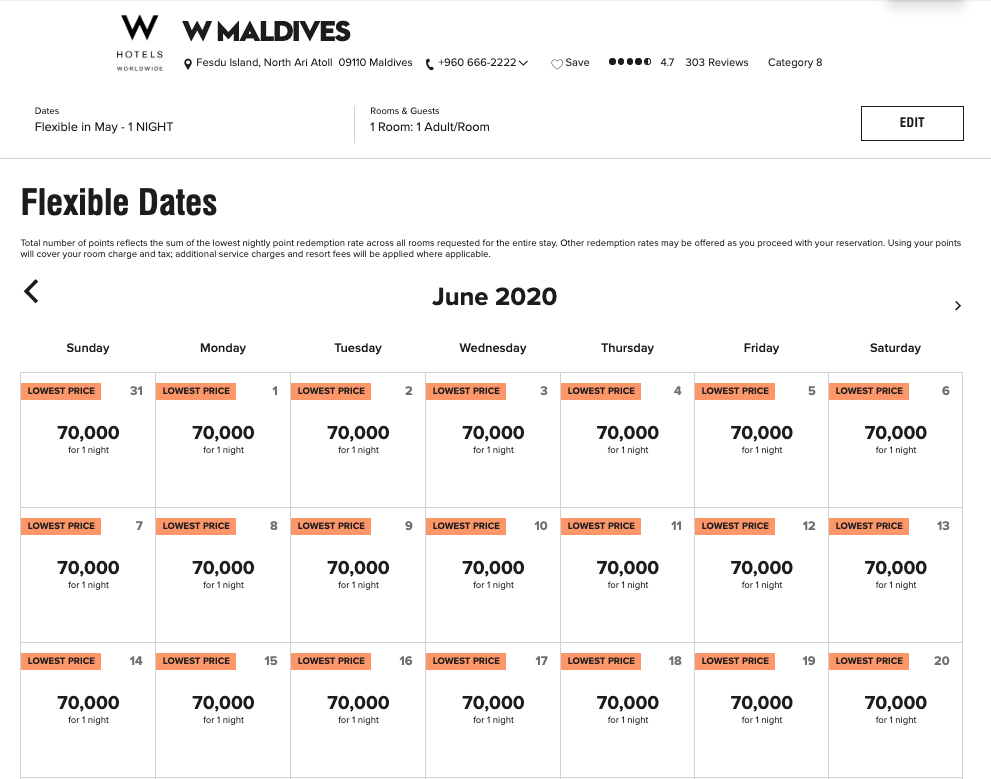

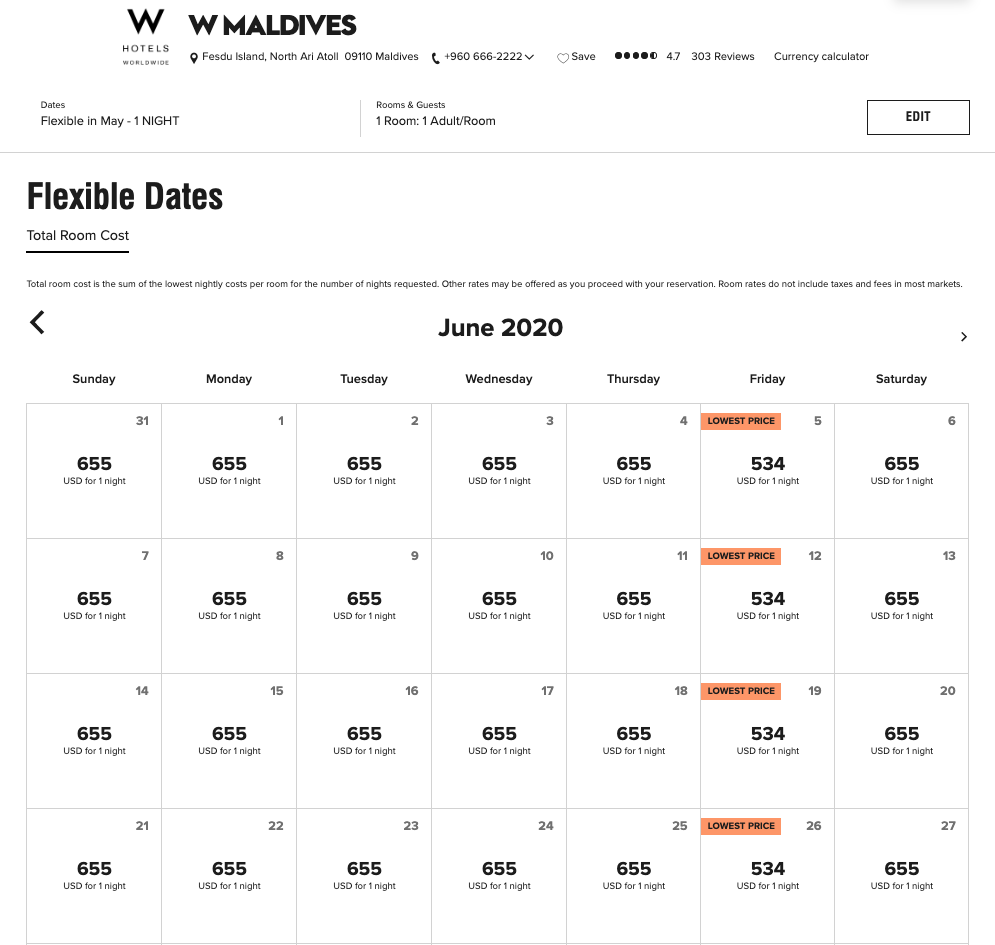

Want a free night at a Marriott hotel? Look no further, and remember, Marriott owns numerous brands such as the Ritz-Carlton, St. Regis, W Hotels, EDITION Hotels, and many more! Each year after your card’s anniversary, you’ll receive a certificate that can be redeemed at any Marriott property worldwide that has availability at 50,000 Marriott Bonvoy points or less. Now at first this can be a little confusing. This isn’t a certificate that’s worth 50,000 Marriott Bonvoy points, nor will there be any deposit of 50,000 Marriott Bonvoy points into your account. Instead, this certificate can be used in place of redeeming 50,000 points. One feature we wish Marriott would offer is the ability to combine this certificate with points. Let’s say you want to stay at the Ritz-Carlton, Lake Tahoe. This is a Category 8 property that’s on the ski slopes of Northstar Resort. Typically this hotel could go for $800 to $1,500+ per night during peak ski season, or 85,000 to 100,000 Marriott Bonvoy points. Ideally, you should be able to use the certificate + additional Bonvoy points (say Free Night Award + 35k or 50k points in this example). However, that’s not how it works at this time. Instead, you could stay at the iconic Ritz-Carlton, Half Moon Bay (just south of San Francisco) for 50,000 points and redeem your Free Night Award, easily saving you over $879 for a January date. Now that you have a Free Night award, you’ll want to make sure you have status to increase your odds of gaining a complimentary upgrade on your next stay.

When it comes to Marriott Bonvoy Elite status, you’ll hit the ground running with the Marriott Gold Elite status. You don’t even have to worry about the qualification requirements for Elite status with this card, since you’ll automatically become Marriott Bonvoy Elite Gold upon activating this card. If you spend $75,000 per year or more on this card, you’ll automatically earn Marriott Platinum status. This is the highest level of status that can be earned via a credit card and without having to qualify with the minimum number of nights for Platinum. On top of that, you’ll also get 15x Elite night credits to help you get to a higher status level if you find yourself within striking distance of the next level, regardless of where you start. Marriott Bonvoy Elite status is a whole other topic, so let’s briefly touch on the benefits of Gold and Platinum status.

Marriott Bonvoy Elite Gold Status, Platinum Status, & the 15 Elite Night Credits Explained

Elite status. Everyone wants it, and most people think it’s difficult to obtain or that they have to “travel a lot” to earn it. While this is true if you don’t have the right cards up your sleeve, co-branded cards such as the American Express Bonvoy Brilliant can be a secret weapon to getting complimentary upgrades. Let’s start off with Gold Status, since the Marriott Bonvoy Brilliant card automatically gives you this status level.

Marriott Gold Elite status has three main benefits: 1) 25% additional Marriott Bonvoy points per every dollar at the property (in addition to the 6x you earn with your AMEX), 2) Enhanced Room Upgrades, and 3) 2 p.m. late checkout. The additional 25% Marriott Bonvoy points definitely sweeten the deal, and effectively mean that your American Express Bonvoy Brilliant card is earning you 7.25x Bonvoy points per dollar (6x per dollar with the AMEX + 1.25 with Marriott Gold status = 7.25x). Next up, is your enhanced room upgrade. Now this isn’t going to take you from the cheapest room in the hotel to the presidential suite, but it’s going to take you from a standard room with the garden view to the partial ocean view. Sometimes you can get lucky and get a really nice upgrade! The final key benefit to Marriott Gold Elite status is that 2 p.m. check out. While it’s not guaranteed, the hotels have often been willing to accommodate our request, allowing us to shower after some extra time lounging on the beach or hitting the ski slopes. All of these benefits come with the card, so you don’t have to hit the 25 Elite nights that are typically required. If you want the full, in-depth run down on every benefit with the Marriott Gold Elite status, check out Marriott’s site here.

If you want Marriott Platinum Elite status, this is definitely a card worth considering. Platinum has four key benefits: 1) a 50% bonus points, 2) a Welcome Gift at check-in, 3) Enhanced Room Upgrades (which includes suites), and 4) 4 p.m. checkout. The 50% bonus effectively gives you 1.5x points per dollar, which when combined with the AMEX, yields you 7.5x Marriott Bonvoy points per dollar spent. Once at the hotel, you get your choice of a welcome gift, which can be complementary breakfast for 2. At some properties, breakfast can easily run $35 per person or more, so this benefit can easily save you $70 or more per day. Next is arguably the most valuable benefit, upgrades that include suites! Now this still depends on availability, but holding Platinum status has allowed us to go from a standard ocean view room to the Junior Penthouse at the W South Beach on Memorial Day weekend. Of course once we received that upgrade we didn’t want to leave, so we were able to enjoy a complimentary 4 p.m. checkout. Just imagine what you’ll be able to do with an extra 4-5 hours of time at the hotel, without being pressured to be out of your room by 11am or 12pm.

In order to enjoy the benefits of Platinum Elite status, you have three options. You can have this card and spend $75,000 per year on it, you can earn it the hard way by staying 50 nights per year at a Marriott property, or our favorite, leverage the 15 Elite night credits.

The 15 Elite Night credits is one of the most unique benefits of this card. Each year, your account will be credited with 15 Elite nights. While you already have Gold Elite status with this card, these credits effectively lower the requirements for obtaining the highest levels of Marriott Bonvoy Elite status. Platinum status drops from 50 nights to a much more attainable 35 nights (50 nights - 15 Elite night credit), Titanium Elite drops from 75 nights to 60 nights (75 nights - 15 Elite night credit), and Ambassador Elite drops from 100 nights to 85 nights (100 nights - 15 Elite night credit). Unfortunately, for Ambassador Elite, you’ll still need to hit the $20,000 minimum annual spend requirement. This benefit has the most value for people who are loyal to Marriott for both leisure and business travel. If you find yourself closing in on 35 nights per year, this benefit will essentially let you hit Platinum status without having to actually spend 50 nights per year in a Marriott hotel.

Value Proposition

Now that we’ve explored the unique benefits of this card and the levels of Elite status that this card opens up, let’s get down to the brass tacks. What value does this card really have? At the Points Passport, we like to make the value proposition for the cards we review easy to understand. In order to do that, we break down the value into two parts: The initial sign up and sustaining costs, or in the Marriott Bonvoy Brilliant’s case, the net value that occurs every year after. Placing an exact value on the American Express Marriott Bonvoy Brilliant card has proven to be difficult due to the abundance of valuable benefits. Different properties provide different perks, which can significantly affect the value of the benefits and elite status, depending on the cardholder’s taste and how much a person takes advantage of them. Additionally, everyone's experience will vary depending on the properties, locations, and personal travel preferences. The bottom line is that if you don't take advantage of the wealth of benefits, you won't see the value in them. Just like if you were to pay with a debit card, you wouldn’t get any points to use for free travel. Okay let’s dive in!

The Sign Up Offer

The current sign up offers for the American Express Marriott Bonvoy Brilliant is 75,000 Bonvoy points. Please keep in mind that American Express implemented a new “one lane rule” limit that prevents new members from collecting the sign up bonus if they previously held a similar Chase product. So what are these Marriott Bonvoy points worth? We frequently redeem our Marriott Bonvoy points for $0.014 to $0.034+ per point, but for this analysis, we’ll base our valuation of the sign-up bonus on the current industry consensus value of $0.008/point.

75,000 Bonvoy points Sign Up Offer x $0.008/point = $600

Annual Benefits

Statement Credits Only

$300 Annual Marriott Statement Credit

$400 Annual Free Night Award (50,000 points x $0.008/point or better)

$700 Total Annual Statement Credits

Sign Up Bonus + Statement Credits - Annual Fee = Net Cost

Year One: $600 Sign Up Bonus + $700 in Statement Credits - $450 Annual Fee = $850 Net Value.

Year Two and Beyond: $700 in Annual Statement Credits - $450 Annual Fee = $250 Net Value

The first year is certainly more valuable with the sign-up bonus, and this card continues to yield more value than it costs to hold annually. That said, we’re not even factoring in the value of the Elite status, additional earning power, $100 Global Entry credit (once per 5 years), or the Priority Pass select lounge access. The value of these definitely depends on whether you use them or have another card that already provides these for you. Our valuation is rather conservative in that we look at this card through the lens of someone that wants to earn more points on their Marriott spend and have a few very nice long weekend trips. At the same time, we get tremendous value out of this card with the Marriott Elite status combined with enjoying luxurious experiences at properties such as the W Verbier completely on points, when the property frequently goes for over $1,200 per night during the ski season!

Additional Card Benefits

PRIORITY PASS SELECT- The Marriott Bonvoy Brilliant card includes airport lounge access with Priority Pass™ Select. If you already hold the American Express Platinum Card, the Chase Sapphire Reserve Card, or a number of other premium credit cards, you may already have access to Priority Pass lounges. If not, you’ll surely enjoy now having access to well over 1,200 lounges across 120 countries. These lounges are available for your enjoyment, regardless of which airline you’re flying on. They include snacks, drinks, complimentary internet access in a quiet space away from all the hustle and bustle of the busy airport terminal. In fact, we recently visited the VIP Sala Lounge Joan Miro in Barcelona airport with our Priority Pass lounge access!

FEE CREDIT FOR GLOBAL ENTRY OR TSA PRE✓® - If you don’t already have Global Entry or TSA Pre, you’ll want to make sure you put that $100 charge (Global Entry) or $85 charge for TSA Pre on your Marriott Bonvoy Brilliant card. Why? You’ll receive a statement credit to cover the fee for either one. Global Entry gives you access to TSA Pre as well, and allows you to enjoy reduced wait times at U.S. Customs at select airports. Both are subject to approved by U.S. Government entities. This credit is offered once in a 4 year period for Global Entry, or one in a 4.5 year period for TSA Pre.

NO FOREIGN TRANSACTION FEES - Most travel sites tend to gloss over this, but Foreign Transaction Fees (FTFs) can easily run up to 3% of your transaction. That means for every $100 USD you spend abroad, you’d be paying $103 before you even factor in the exchange rate. While this seems small at first, that quickly grows to $30 in fees for every $1,000 in spend. With the Marriott Bonvoy Brilliant, however, you don’t have to worry about that additional Foreign Transaction Fee while traveling abroad. This is a major key, since you’ll want to pay for your Marriott hotel stays on this card and not having to pay any additional fees for being overseas is always a win.

PREMIUM INTERNET ACCESS - As long as you book through Marriott.com (or the mobile app), you’ll receive free in-room, premium internet access. This can be very useful when you’re overseas and want to FaceTime your friends & family at home.

CAR RENTAL LOSS AND DAMAGE INSURANCE - Rental cars are an important part of any vacation or trip, so you’ll want a little additional peace of mind that your rental is insured. While this isn’t a standalone primary policy like on the Chase Sapphire Reserve, it does kick in on top of either the insurance policy you purchase from the rental company, or your own auto insurance policy if you denied the rental company’s insurance. This does cover the car if it’s stolen or damaged. Please make sure to read the fine print, which will include the exclusions and restrictions, before you decline the collision damage waiver at the rental car counter.

PREMIUM GLOBAL ASSIST® HOTLINE - If you run into any issues while traveling, you’ll have 24/7 access to the Premium Global Assist Hotline to help you with any medical, legal, financial, and other select emergency coordination and assistance services. These legal and medical professionals are English-speaking, and can direct you to where you need to go. This hotline can also assist you with any emergency hotel check ins, cash wires, missing luggage, lost or stolen passport, even prescription replacements and more! This kicks in when you’re traveling more than 100 miles from home. The only catch here is that card members may be responsible for any costs charged by the third-party services providers.

BAGGAGE INSURANCE PLAN - As long as you purchase your entire fare for a Common Carrier ticket (i.e.: plane, train, ship, or bus), pack your bags and leave your worries at home! The Baggage Insurance Plan covers you in the event that your eligible bag is lost, damaged, or stolen. This covered up to $1,250 for carry-on baggage, and up to $500 for checked baggage. For New York State residents, there is an aggregate maximum limit of $10,000 for all Covered Persons per Covered Trip (basically if you bought tickets for yourself, friends, and family).

RETURN PROTECTION- American Express is well known for its customer first approach to being a card issuer. Right in line with that mantra is the Return Protection that’s included with this American Express card. This allows you to return an eligible purchased to American Express if for some reason the merchant won’t accept the return. The full purchase price is covered, but shipping is not. Sound good? We think so, but the catch is that there’s a limit of up to $300 per item, with a maximum of $1,000 per calendar year per card account. These purchases must be made in the U.S. or U.S. territories.

OTHER BENEFITS

ENTERTAINMENT ACCESS

SHOPRUNNER

FRAUD PROTECTION

YEAR-END SUMMARY

APR - Annual Percentage Rate

While we’re not financial advisors, nor do we give any type of financial advice, our first rule at Points Passport for taking advantage of credit card benefits, maximizing earning points, and optimizing redemptions is to never carry a credit card balance. If you follow us on Facebook, Instagram, or read our articles regularly, you’ll know we don’t pay interest on our cards and believe in paying off all of our credit cards every month in full. That way, the cards we keep in our wallet always yield a positive ROI (Return On Investment). The second we carry a balance, we find that we lose too much value, and the charges on the card aren’t worth the points they yielded. If you’re like us and pay your balance in full, please feel free to skip down to The Final Point.

If for some reason you either forget to make a full payment or you’re in a situation where it makes sense to carry a balance for you, you’ll want to know what the interest rates, APR (Annual Percentage Rate), and other fees are. The Annual Percentage Rate for the American Express Marriott Bonvoy Brilliant credit card ranges from 17.24% to 26.24% as a variable APR interest rate on purchases at the time this article was written. The APR for Balance Transfers is also 17.24% to 26.24%, while the APR for cash advances is at an astonishing 26.24%. Basically this is a last resort if you’re short on cash. As mention previously, the Annual Membership Fee is $450 per year, and there are additional fees ranging from $5 to $10 or 3% to 5% for balance transfers. Again, these are all aspects that we tend to skip over since the way we take advantage of credit cards and travel hacking requires that we treat using them the same way as you would use a debit card or pay with cash. A major key for us is to not pay interest or fees, except for the annual fee. We even have a few tips and tricks when it comes to the annual fee, so feel free to email us, message us on Facebook, or DM us on Instagram if you want some free tips on navigating the annual fee. Make sure to check with American Express for the latest APR percentages, as they can fluctuate rather frequently. (See full terms, rates, & fees here). If you need to contact American Express regarding the terms, offer details, and the latest rates, you can also contact them at American Express 200 Vesey Street, New York City, New York 10281, United States.

The Final Point

While there are many premium travel cards today, we believe the Marriott Bonvoy Brilliant from American Express compliments other premium cards in our wallet quite well. Even if you only stay at a Marriott once or twice per year, you’ll be sure to get much more from this card than the annual fee. Despite the signing bonus being only 75,000 Marriott Bonvoy points, that’s enough for a night at the W Maldives! From the increased earning power, the Marriott Elite status, 15 Elite nights, and the $300 annual Marriott credit statement, to the free award night certificate, this card is a serious travel tool to have in your wallet, wherever your thirst for adventure and relaxation takes your throughout your travels!

Interested in applying? We’d greatly appreciate your support from all of us at the Points Passport by using our referral link below. We'll both get rewarded once you're approved. With our referral link for the American Express Marriott Bonvoy Brilliant card, the sign up bonus is 75k with our referral offer, and you’ll apply securely and directly with American Express!

For American Express’s full terms, rates, fees, and other cost information, please click here.

This article contains references to one or more products from advertisers from which Points Passport may receive compensation when you click on links to these products. Terms applies to the offers listed on this page. Please review the term offers before applying.

Editorial Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.