Chase Cards Now Earn Up to 5X Ultimate Reward Points on Groceries

5X Ultimate Rewards Points at Grocery Stores, Target, and Walmart

Want 5X Ultimate Reward points on groceries? We do too! With our current stay at home lifestyle, you might feel like your Chase cards aren't quite as rewarding as they were just a few months ago. You're not alone, as most of these card benefits were originally geared towards travel. These days, we're finding that our grocery bills have increased, while our travel expenses are idling at $0. Chase recognized this shift in spending patterns and has offered an advantageous solution. From May 1, 2020, to June 30, 2020, you can earn up to 5X Ultimate Reward points on the first $1,500 per card, per month (this minor detail is significant, so keep reading below!)

Grocery Stores, Target, Walmart, and More!

To make things even more rewarding, Chase is considering select Target and Walmarts as grocery stores, as long as that store has a grocery section. This bonus is very rare, as Target and Walmarts are usually ineligible for bonus points on grocery spending. Additionally, grocery delivery services such as Instacart are included in the new, temporary bonus category. All of this is on top of being able to earn this bonus at your local Safeway, Publix, Krogers, Raley's, Whole Foods, Trader Joes, and much, much more.

Details of the Ultimate Reward Bonus Points at Grocery Stores

As with all good things, there is a catch. The limit on the grocery bonus is capped at the first $1,500 you spend per month, between now and June 30, 2020. Depending on your card, that means you'll earn a maximum of 4,500 to 7,5000 Ultimate Reward points. That said, this is a per card limit, so if you have multiple Chase cards yourself or in your household, these points could add up!

Full List of Eligible Chase Cards

Current Chase Cards and Grocery Bonus Amounts

Marriott Bonvoy Boundless - 6X Bonvoy points

Marriott Bonvoy Bold - 6X Bonvoy points

Chase Sapphire Reserve: 5X Ultimate Reward Points

United Club Card - 5X United miles

United Infinite Club Card - 5X United miles

Chase Sapphire Preferred Card - 3X Ultimate Reward Points

United Explorer Card - 3X United Miles

Southwest Rapid Rewards Plus Card - 3X Rapid Rewards points

Southwest Rapid Rewards Premier Card - 3X Rapid Rewards points

Southwest Rapid Rewards Priority Card - 3X Rapid Rewards points

IHG Rewards Club Premier Credit Card - 3X IHG points

IHG Rewards Club Select Credit Card - 3X IHG points

World of Hyatt Credit Card - 3X Hyatt points

Hyatt Credit Card - 3X Hyatt points

Iberia Visa Signature Card - 3X Avios

British Airways Visa Signature Card - 3X Avios

Disney Premier Visa - 3X Disney Rewards Dollars

Legacy Cards (Not open to new applicants)

United Presidential Plus Card - 5X United miles

United MileagePlus Card - 3X United miles

United MileagePlus Awards Card - 3X United miles

United MileagePlus Select Card - 3X United miles

IHG Rewards Club Select Credit Card - 3X IHG points

Chase Cards vs. Debit or Cash

The ROI (Return On Investment) on paying for everyday expenses, such as groceries, via cash, checks, or even debit cards, is always zero. That's why we encourage people to optimize their spending strategies with the right credit cards. They can be great personal finance tools to either reward you with points for future travel or, at a minimum, these points can be used for other purchases or statement credits (essentially turning the points into "cash back"). While the points are worth the most when redeemed for travel, there is certainly flexibility in how you redeem the points you've earned. To us, Chase has one of the most straightforward and rewarding points ecosystems. In fact, to receive these bonus points on groceries, you don't even have to activate anything! Simply use your eligible card at your local grocery store.

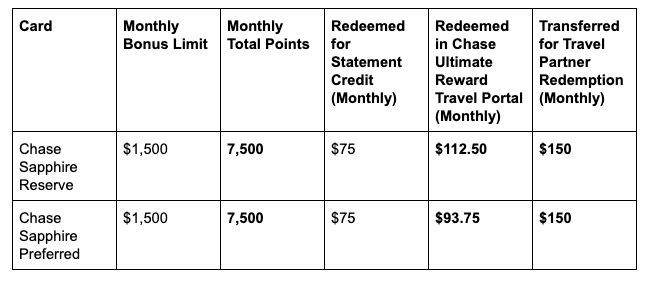

Below is a simple table showing you the amount and value of the rewards for a couple of example cards. These calculations assume that you max out the limit on one Chase card.

The Optimization Strategy: AMEX vs. Chase

We've seen a lot of temporary changes to card benefits and bonus point categories with both American Express and Chase recently. This might have you wondering, which card should I use for groceries to take advantage of this? Here's our strategy and the data behind it. Since the Chase grocery bonus is limited to the first $1,500 but is valid at Targets and Walmart with grocery stores, we'll use the Chase Sapphire Reserve at Target and grocery stores first. Then, once we've hit the $1,500 limit, we'll switch over to the American Express Gold Card, which always earns us 4X Membership Reward points at U.S. Supermarkets (this is a permanent card benefit).

Now if you want to take your optimization to the next level, you could spend $1,500 per month per Chase card either on gift cards (such as Amazon) at grocery stores or just at Target in general, then use your American Express Gold Card at Safeway or Publix on groceries and earn 4X MemberShip Rewards. Please keep in mind that we don't want to encourage you to spend more than you usually would. However, if you know that you typically spend a couple of thousand dollars per year at places you could benefit from having gift cards and want to take advantage of this bonus, this is a strategy worth considering

Final Point

We're excited to see Chase adding a grocery store bonus to some of their most popular cards! Prior to this, the only way to earn 5X Ultimate Reward points was to use the Chase Freedom Card during the months in which the rotating bonus category happened to be grocery stores. For the next two months, you don't have to do anything other than pay for your groceries with your Chase Sapphire Reserve, Sapphire Preferred, or other eligible Chase cards. This strategy is a great way to maximize Ultimate Reward points so that when it's safe to travel again, your epic trip is entirely free and paid for by the money you had to spend anyway on food and essentials during the quarantine. We're looking forward to brighter days, and getting some bonus points on these temporary categories is indeed a silver lining!

Next Steps

If you don't have an eligible Chase card and are interested in one, check out our deep-dive reviews on the Chase Sapphire Reserve, Chase Sapphire Preferred, and Chase Freedom cards. If you know which card is best for you, please consider using the link below to learn more with our partners at CreditCards.com. Simply click the link, scroll to the card you're interested in, and learn more. Then, you'll be taken directly to Chase.